BearTax is also integrated with TurboTax Online. What countries do you support? If you can hack this site you can also hack Google CryptoTraderTax Thank you so much for your help. Add your sources of cryptocurrency income from the tax year.

Is There An Open Source Fifo Tax Calculator Supporting Short And Long Term Gains? : Bitcoin

Do not use URL calcjlator services: always submit the real link. Only requests for bitcoin tax calculator free bitcon large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy. News articles that do not contain the word «Bitcoin» are usually off-topic. This subreddit is not about general financial news. Submissions that are mostly about some other cryptocurrency belong. Promotion of client software which attempts to alter the Bitcoin protocol without overwhelming consensus is not permitted.

File Your Cryptocurrency Taxes With Ease

Back in the cryptocurrency craze hit the mainstream world. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors.

Minimize your tax liability with our easy to use calculator

Do not use URL shortening services: always submit the real link. Only requests for donations to large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy. News articles that do not contain the word «Bitcoin» are usually off-topic. This subreddit is not about general financial news. Submissions that are mostly about some other bitcoin tax calculator free belong.

Promotion of client software which attempts to alter the Bitcoin protocol without overwhelming consensus is not permitted. Trades should usually not be advertised. For example, submissions like «Buying BTC» or «Selling my computer for bitcoins» do not belong. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should not be re-posted.

Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit’s self-serve advertising. Do not post your Bitcoin address unless someone explicitly asks you to. Be aware that Twitter. No other Bitcoin service will save as much time and money. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio.

All in all, we were very pleasantly surprised by the CoinTracking platform and we cant wait to see where it all goes from here and what new features they will implement in the future. Its straightforward to use and supports all coins and all exchanges. With a wide range of supported cryptocurrencies including bitcoin, Ethereum, Ripple, and thousands of others filling in those tax forms becomes very straightforward.

As mentioned in the german thread i really like your «easy enter» feature. One of my topused bookmarks» «I love it! Can’t wait for the altcoin trading to be included. The bitcoin taxation season is almost upon us, which highlights a very important problem. Most people are unaware of how they should incorporate bitcoin into their tax assessment.

Thankfully, there are quite a few tools available which will help users take care of these problems with relative ease. It is important to keep in mind very few countries require bitcoin users to take cryptocurrency earnings into account right. As the name of this powerful tool suggests, the ultimate objective is to help users calculate capital gains and losses for bitcoin. Since most people arent aware of the cost-bases of every BTC they own or how much profit they made exactly, it is very important to have access to the right data.

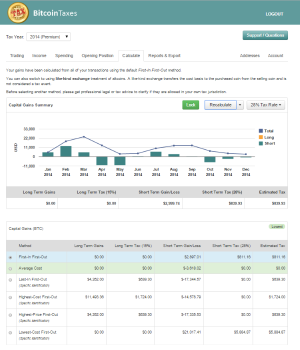

Bitcoin Taxes claims to offer this solution free of charge, which makes it quite a powerful tool to help during the tax season. Some of the Bitcoin Taxes features include support for major world currencies, importing mining income, and importing trade histories from multiple exchanges.

Additionally, the company also provides tax professional and accountant packages for users looking for more advanced bitcoin tax solutions. Additionally, the platform also supports various altcoins, including Ethereum and Dogecoin. The name CoinTracking does exactly what it says: track users coin history and determine how much tax needs to be paid as a result.

Moreover, this platform is specialized doing extracting trading information from individual exchanges, which makes it quite attractive. Generating the capital gains report for cryptocurrency activity remains the primary objective for CoinTrack.

Making money on bitcoin, ethereum, and scores of other cryptoassets has been remarkably easy this year. But in the US, paying taxes on those gains could be a lot more complicated. Transactions that are routine to experienced crypto enthusiastslike hard forks, or swapping between coins at the tap of a buttonare fiendishly complicated when it comes to reporting to the Internal Revenue Service. And make no mistake: the agency is determined to make sure people pay what they owe.

Over the course of bitcoins booms and busts, the IRS has noticed that tax returns arent lining up with the manic popularity of the cryptocurrency, according to Tech Crunch. To help confused crypto investors, accountants like William Brock now specialize in the peculiarities of how the US tax code applies to these burgeoning assets.

If youve made money on crypto this year, here are some pointers he says you should keep in mind. Needless to say, this is not legal advice and its far from exhaustiveif you have specific questions, its best to consult with a tax professional. People typically think about paying taxes on an investment after theyve sold it. But switching from one digital asset to another will trigger capital gains, even if you dont convert to dollars as an interim step.

For example, trading ether for bitcoin and not reporting the gains on the ether will not pass muster with the IRS. A way around this relies on a like-kind exchange as described in Section of the tax code.

Are we having fun yet? The rules on this can be ridiculously strict, Brock says. Smart Tax Accounting Moves For Cryptocurrency Traders If you have multiple cryptocurrency coin trades, consider a trade accounting solution dedicated to coin transactions. The program should calculate taxable income and loss based on IRS rules for coin transactions. It should generate capital gains and losses reports to support Form and other income statements. The program needs to account for all coin transactions, including coin-to-currency trades, coin-to-coin trades, receipt of coin in a hard fork or split transaction, purchases of goods or services made with a coin, and mining revenue.

I reviewed two coin accounting solutions that fit the bill: Bitcoin. Tax and CoinTracking. Both programs provide options for different outcomes and in general, stick with the default method to stay clear of potential IRS trouble. Coin exchanges do not provide taxable income reports Dont look to your coin exchange for much help with tax reporting.

They dont keep cost-basis information and are unable to give the users online tax reports. Coin investors are responsible for generating their accounting and tax reports. With uncertainty on tax treatment due to lack of sufficient IRS guidance, many coin traders wind up under-reporting taxable income on coin transactions. In most cases, it may be inadvertent, but sometimes, its willful.

Using accounting software shows an attempt to be compliant. Bitscary Jan 17 at You would have to pay less I searched the forum for tax, but couldnt make up my mind. Complicated matter! You may also want to browse the taxes tag since we have a lot of other questions on this topic.

Nate Eldredge Jan 19 at Ill start this off by saying Im not a tax professional, so take this advice as you will At the time you purchase your bitcoin, your purchase price becomes your cost basis. Again Im not a tax professional, but this is my understanding of how it all works based on lots of research.

Check out our other apps including Kinetic BrowserA FREE web browser app that can beused to navigate the world wide web on large screen smartphones with one hand using a series of kinetic hand movements. Find it at well worth a look! Just select your smartphone type via the links for directions on how to download for each store.

See this section for more details. The toolcan then calculate profit and loss for each transaction and keep a runningscore. There is a summary screen that tells you your current value and ‘cash out’ profit or loss, you can use this tool to drive your trading strategy or for calculating the capital gain in-between allthese price movements useful for working out tax liability. As a shorthand on this site and in the app a cryptocurrency is referred to as coin.

With exponential gains in value and thousands of new retailers now accepting it as payment, Bitcoin has suddenly become one of the hottest discussion topics around the country.

Bitcoin BTC is currently the most circulated virtual currency also referred to as cryptocurrency, or crypto in the world and can be exchanged for U. You may spend virtual currency to pay for products or services, or you may treat it like an investment or commodity and hold onto it. But how is a virtual currency like Bitcoin taxed and treated by the IRS? Do you have to pay taxes on Bitcoin?

Depends on what you do with it. How is virtual currency like Bitcoin handled for federal tax purposes? Virtual currency held as a capital asset, like stocks or bonds, is treated as property by the IRS.

For the sale or exchange of cryptocurrency that is not a capital asset by the taxpayer, its considered as an ordinary gain or loss. If a taxpayer receives BTC as payment for products or services, how should they determine gross income?

This program will look for any transaction where two different currencies are included in a transaction,and are both designated within accounts you own ex. It will also look for transactions from an Income account and an Asset account.

These are consideredtaxable income events and included in the report. Accounts are split into three categories. Assets, Expenses and Income. Assets are accounts you own and you wish to calculate capital gains.

Note that you’ll probablywant to include liability accounts in this category, since paying down a CC is really the additionto a negative asset if you pay your credit card with a cryptocurrency, that is Income are accounts from which you receive an Asset. For example, if you mine bitcoin and you havean ‘Income:Mining’ account. Expenses are accounts where expenses go. When expenses are one or more of the outputs for trades orincome transactions, they are deducted from the capital gains received.

In any other transaction, such as those associated with transferring assets aroundthey are ignored for reporting,but still kept track of, so that funds spent in expenses don’t appear as a basis for sells. That is comforting to me. Bitcoin and crypto are a bit like religion.

There are a lot of truebelievers out there, me included. But at least some people are stepping back and taking money off the table.

Cointracking Bitcoin & Digital Currency Portfolio/tax Reporting

Sasha Hodder Jan If you can hack this site bitcoin tax calculator free can also hack Google Import Your Trades 2. Apart from Formthere are options to export the data into various formats depending on your needs. We are not certified accountants and not professional financial advisors. Alternatively, if the list is a bit longer, then you can compile them into a sample format provided and upload them to be processed in a flash. Review your transaction data and download your completed crypto tax report.

Comments

Post a Comment